Hotel web capture – Global

The 2026 Hospitality Benchmark Report helps hoteliers assess performance, pinpoint improvements, and set goals. These benchmarks focus on the web capture channel on a global average for reputation management and cart abandonment.

Web capture: introduction

The web capture channel represents how well hoteliers collect and activate guest data from across the web, including their own website, OTAs, and review sites. Knowing how guests perceive their experiences can help hoteliers make enhancements to manage their online reputation, improve the guest journey, and experience fewer website abandonments and more rescued shopping carts.

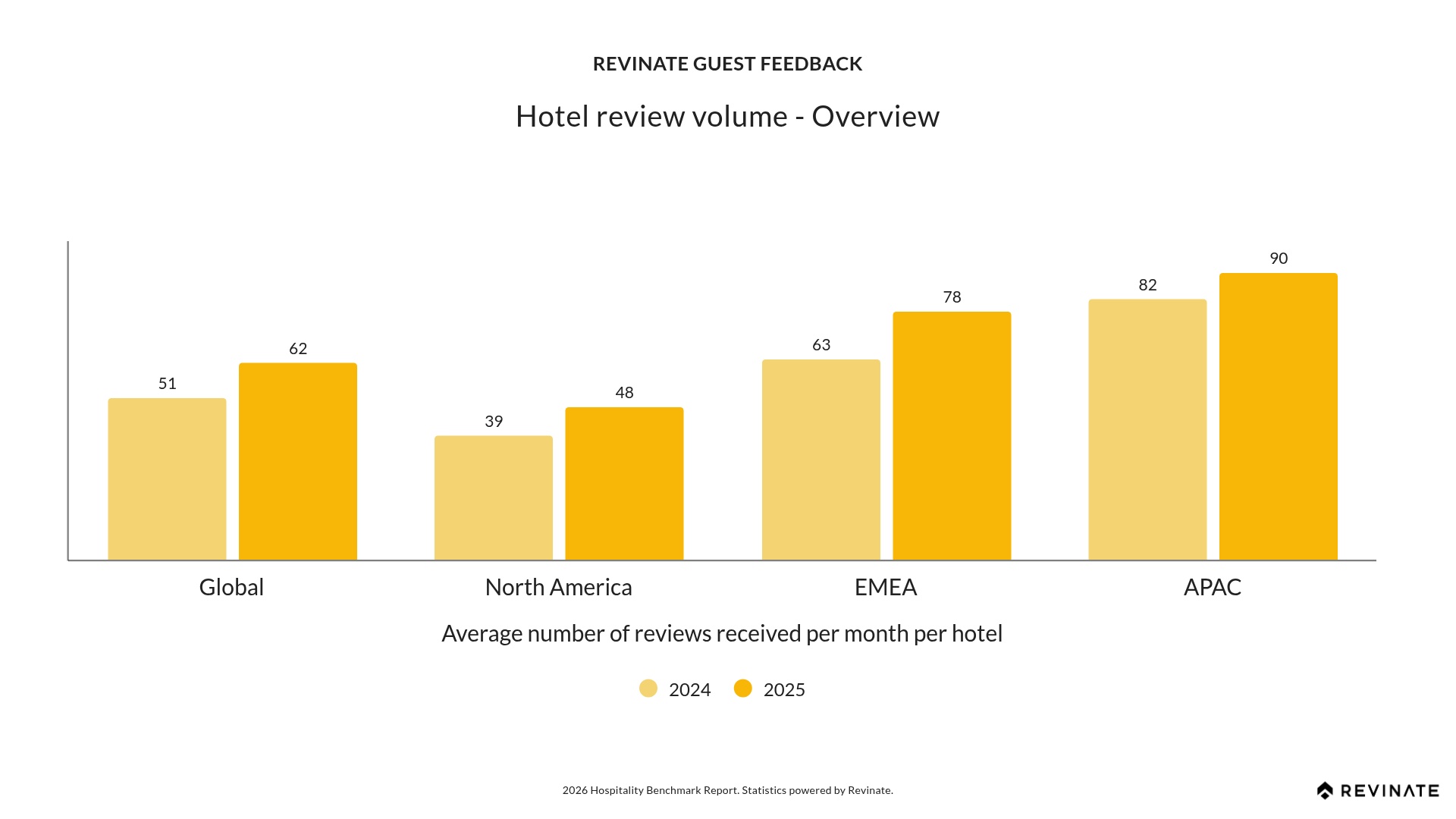

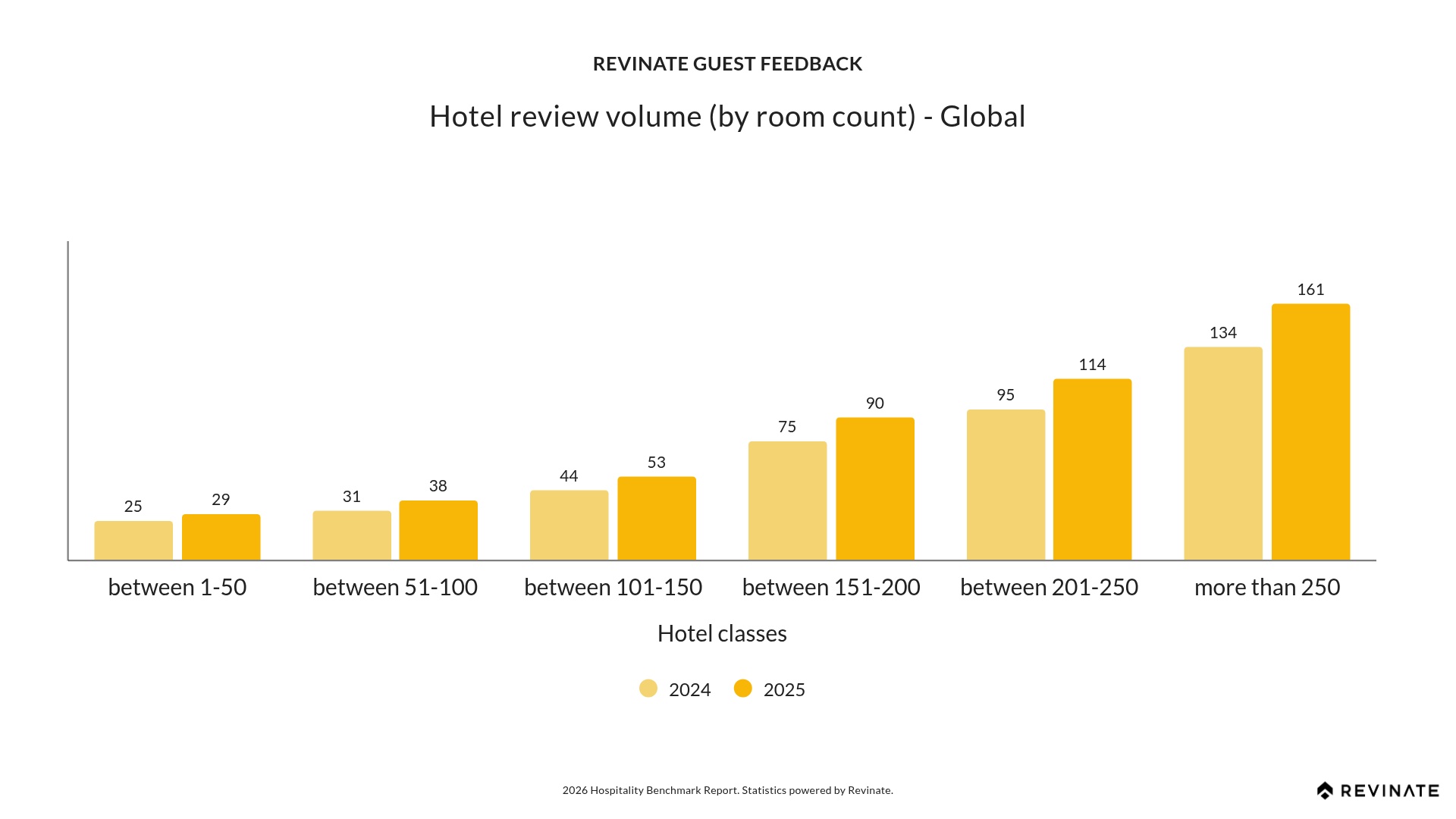

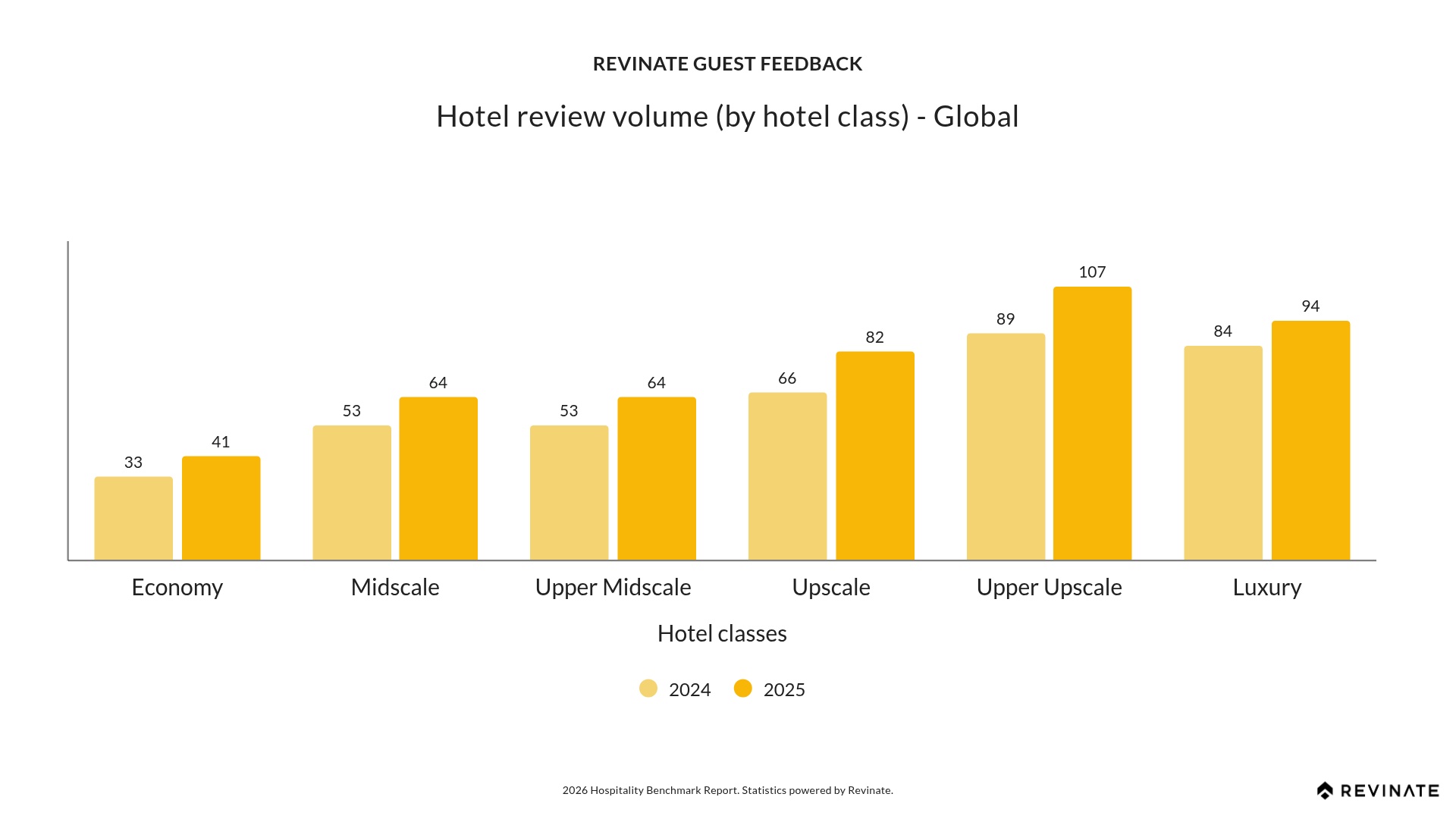

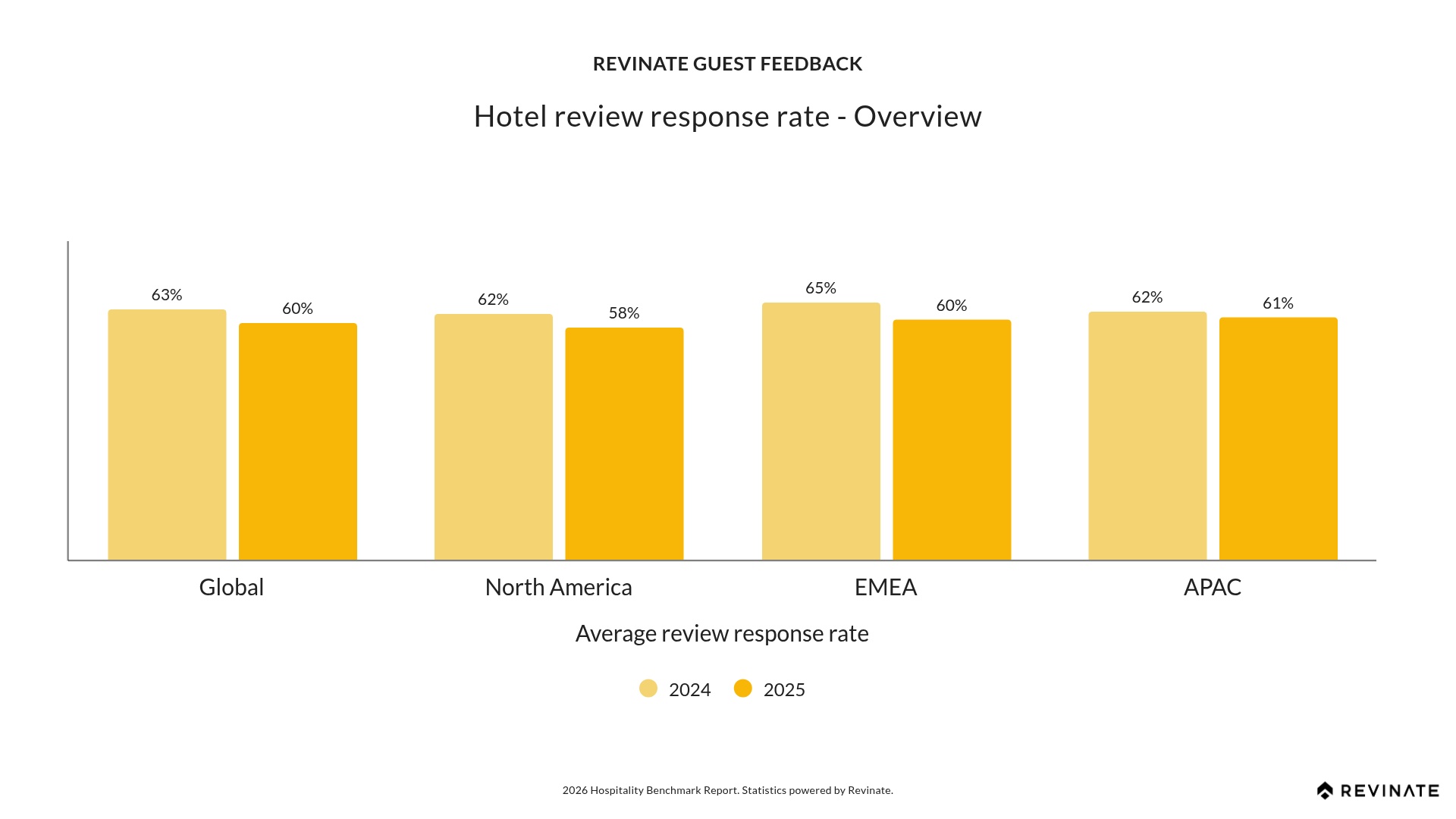

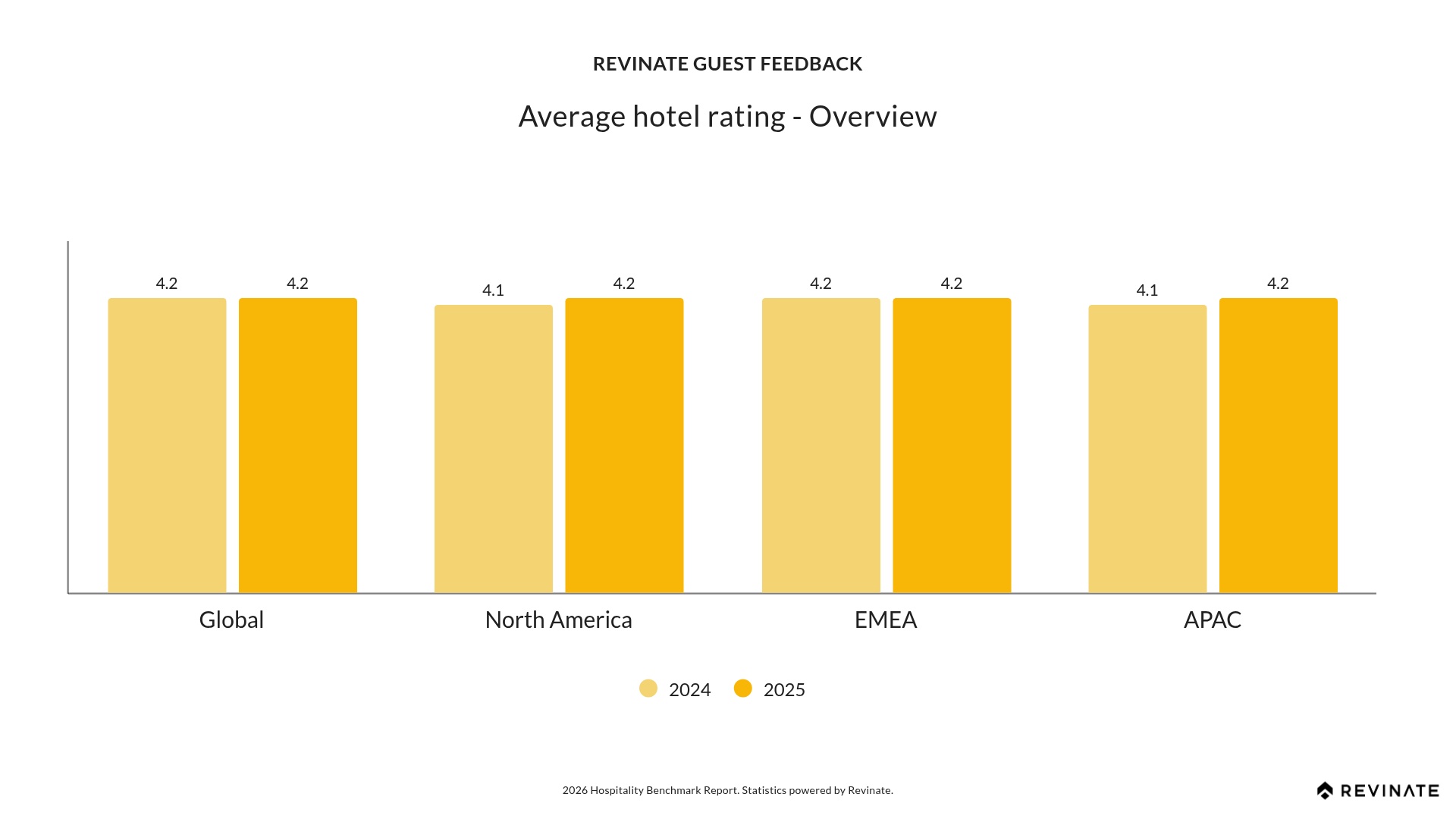

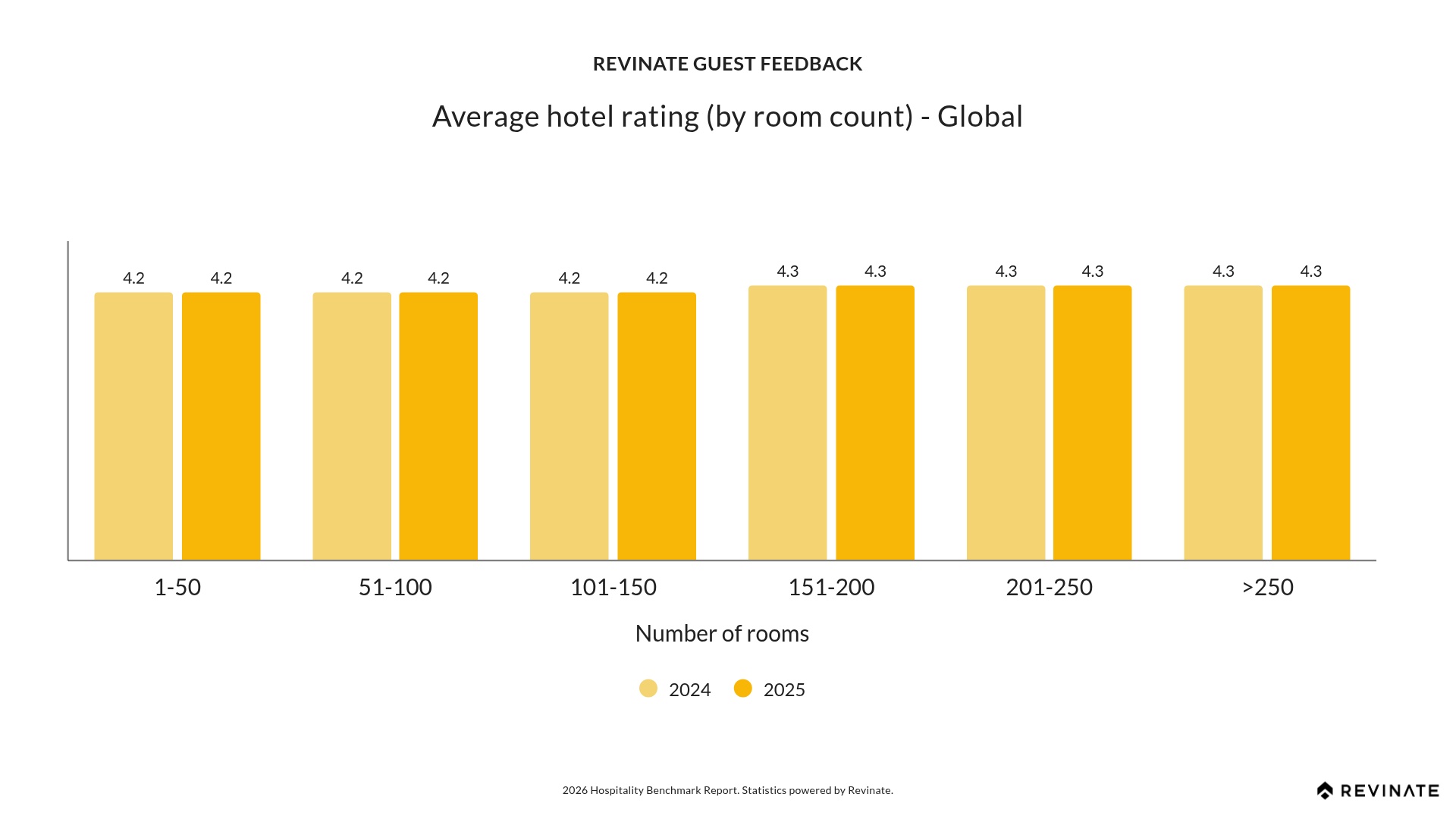

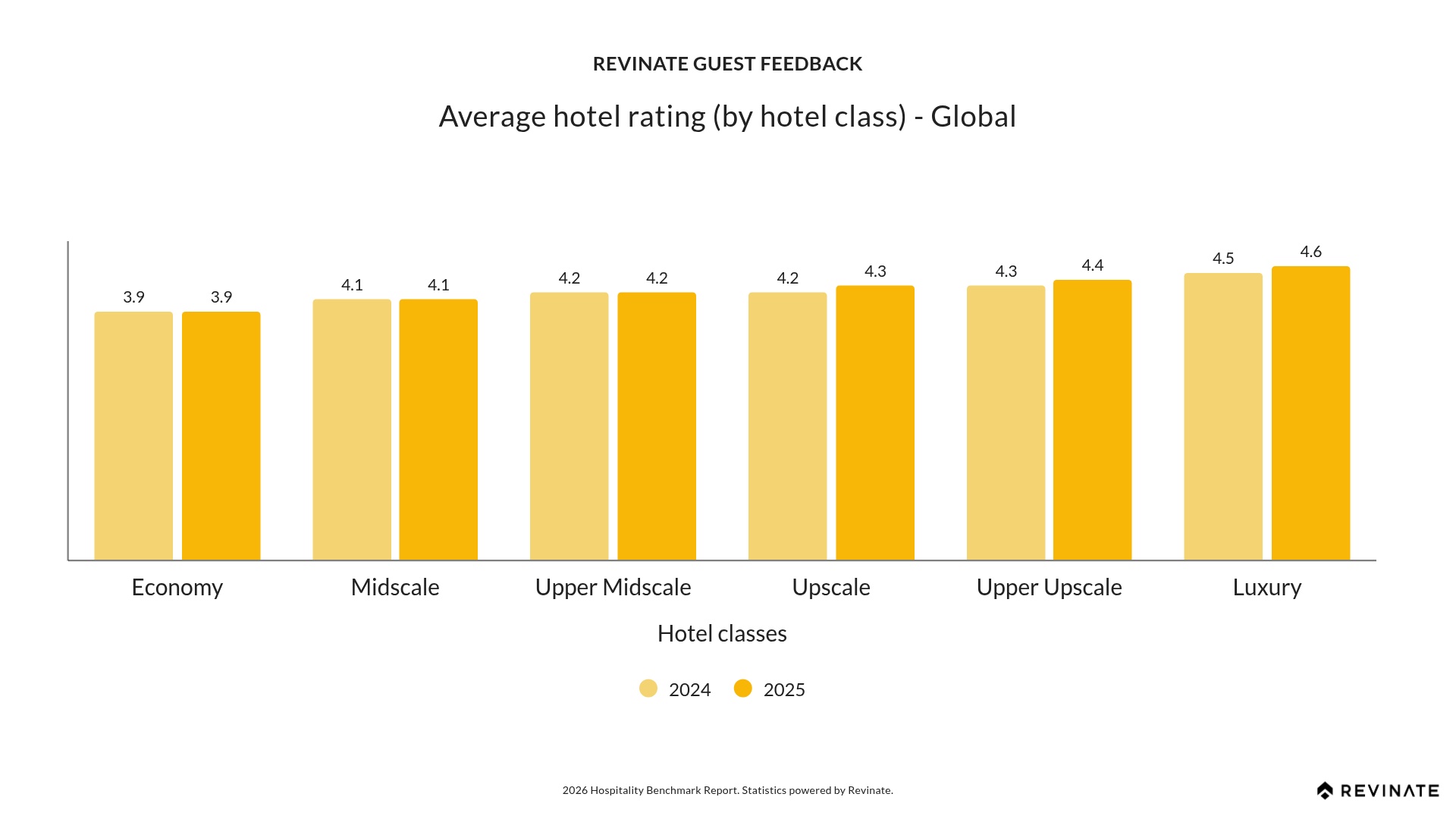

Reputation management

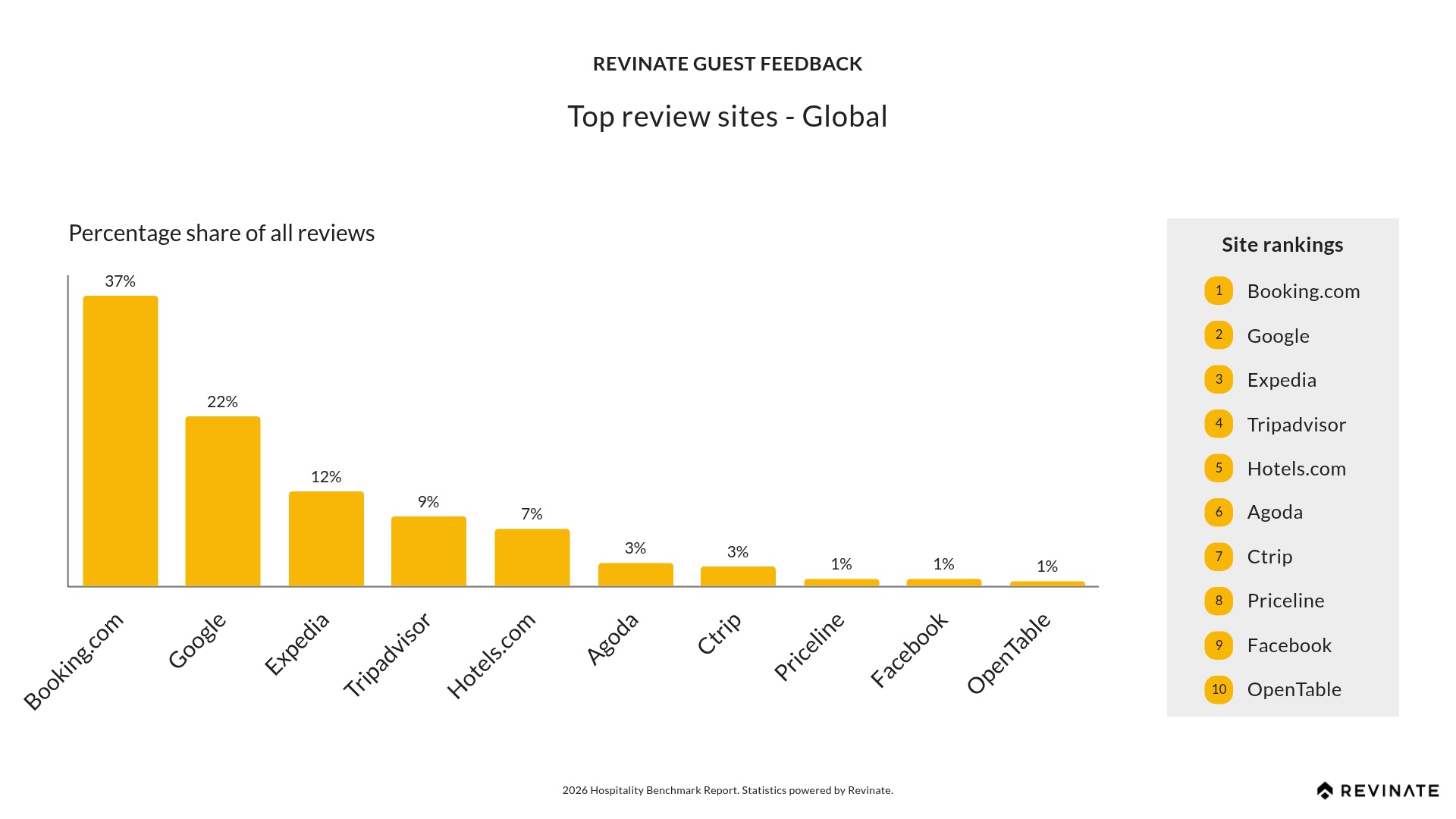

Guests have opinions about their stays and are willing to share them – typically on a review site. Since reviews are one of the top factors for booking decisions, savvy hoteliers know to monitor those sites and respond. Not only does this allow the property to help rectify any negative experiences, it also shows potential bookers that the hotel cares about the guest experience.

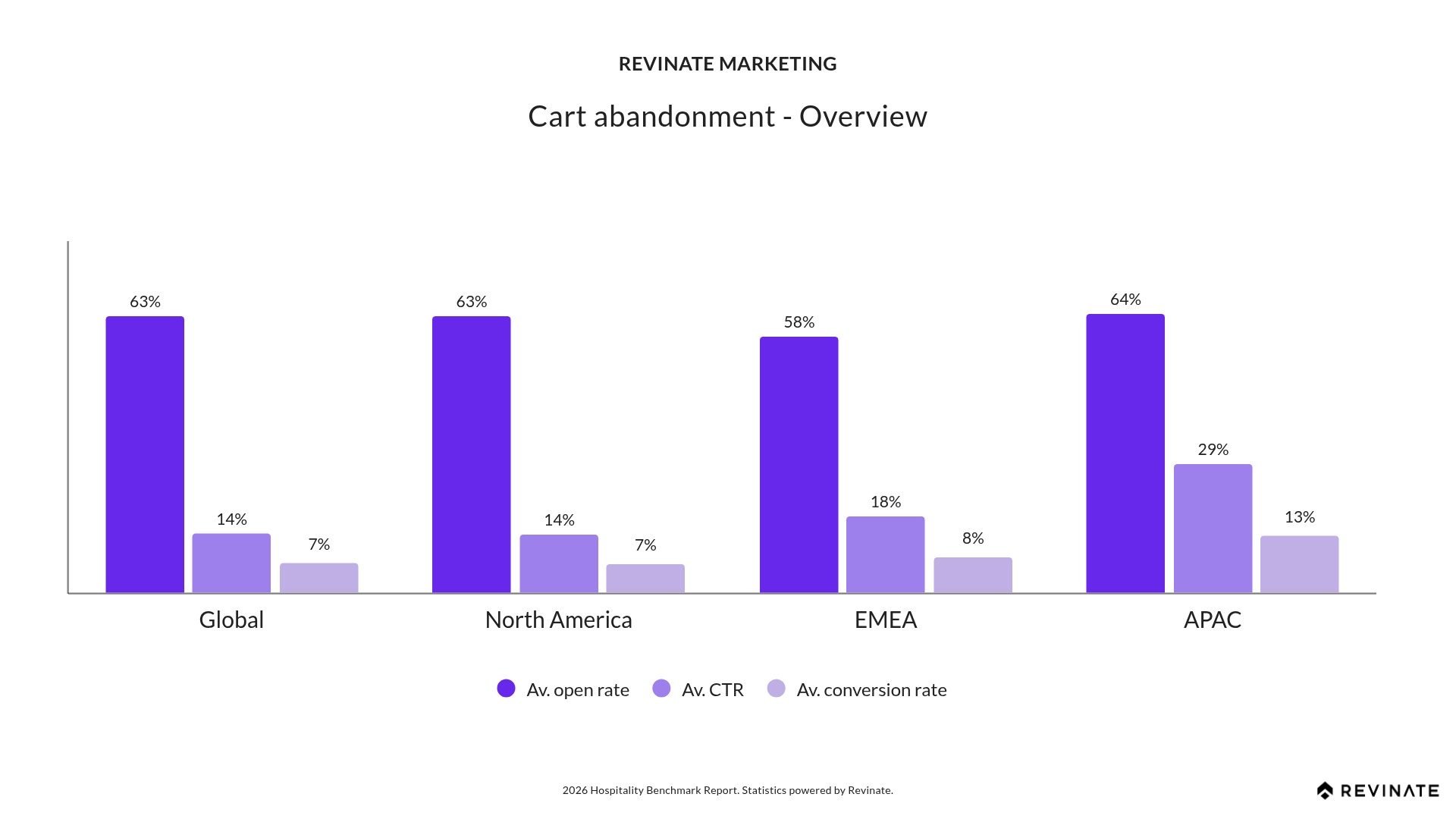

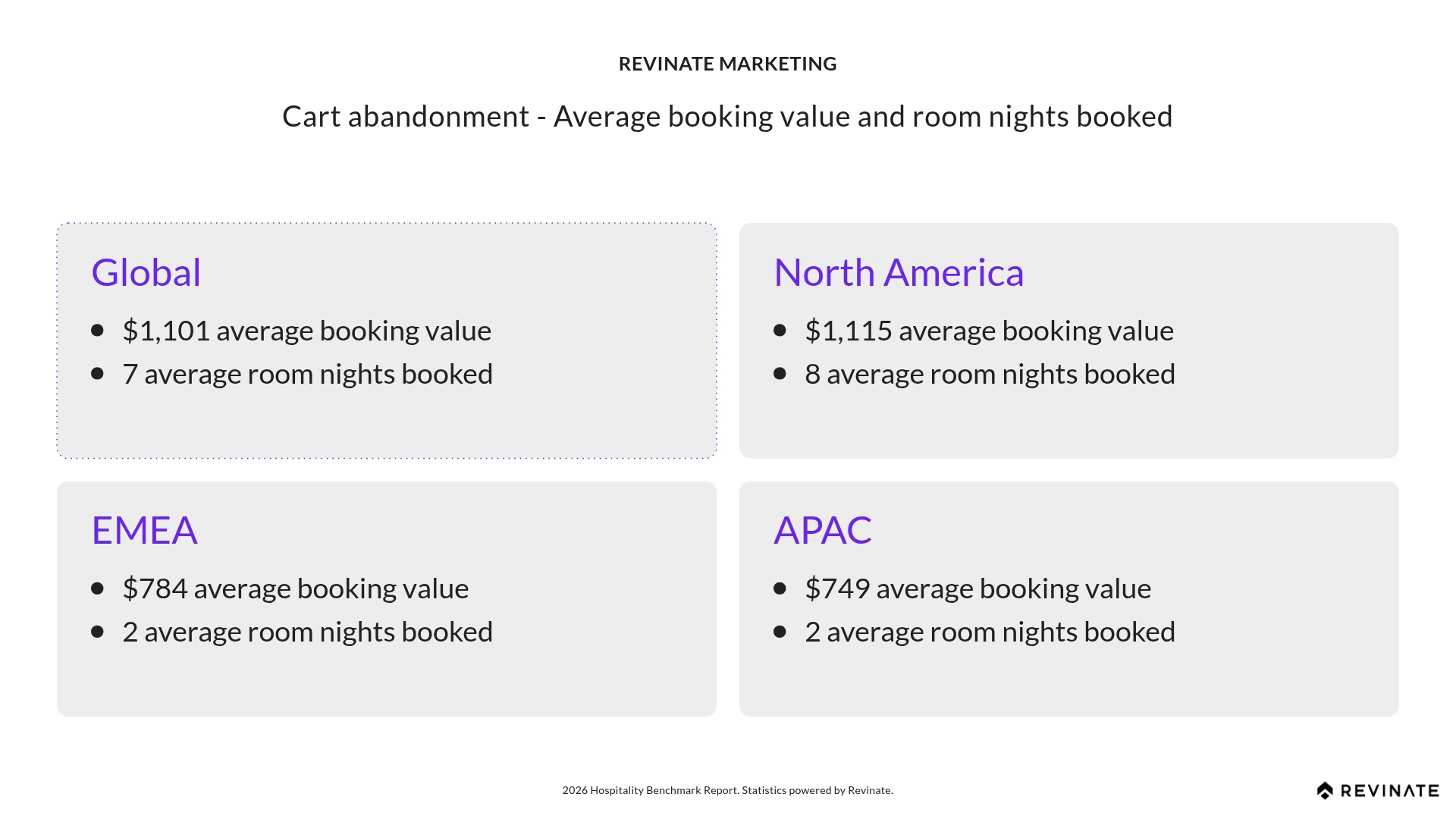

Cart abandonment

Guests abandon shopping carts for all sorts of reasons, even when they’re so close to booking. Guests get distracted by notifications, they want to confirm plans with someone, or they want to compare prices, just to name a few reasons. But that doesn’t mean they can’t be won back with a carefully timed email. Check out how shopping cart abandonment campaigns performed last year.